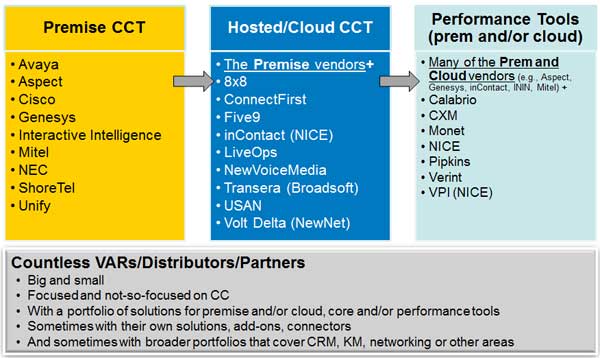

The “Cloud” contact center technology market is maturing and the vendors are all in. A solid, experienced set of cloud-only players set the competitive stage, led by companies like 8×8, Five9, inContact (recently acquired by NICE), LiveOps, and Transera. These companies have enough market presence to make Gartner Magic Quadrants or other analyst evaluations.

There are a plethora of options for those willing to accept a little more risk, such as: ConnectFirst, NewVoiceMedia, Ring Central, Talkdesk (and too many others to list as well as new ones still emerging). Some come from a “carrier” background, so offer network too, whether as software providers (e.g., inContact, 8×8, USAN) or Value Added Resellers (e.g., Century Link, Verizon). Some started with basic enterprise telephony but offer contact center functionality as well (e.g., 8×8, RingCentral).

Vendors that offer premise solutions are strongly committed to offering cloud solutions as well, directly and/or through partners. Most of these have multiple offerings and started from a hosted approach, often with more custom solutions. They may leverage the same platform, but had to ensure multi-tenancy to support a true cloud offering, not just hosted or private cloud (e.g., Avaya and Cisco through partners). Some have bought their way into the cloud space (e.g., Genesys, Mitel, ShoreTel) while others have built their way in (e.g., Interactive Intelligence – first with their Communications as a Service (CaaS) hosted (or private cloud) option leveraging their CIC premise solution, and now with PureCloud as a totally different architecture and their entry to the true cloud world).

To be a serious contender, these vendors have to offer performance tools, whether their own, through partnerships, or some combination. This is an area where we have been seeing acquisitions (e.g., Avaya of KnoahSoft, inContact of Uptivity, Mitel of Oaisys, NICE of inContact) and expect more.

The following figure shows the main types of players in the vendor landscape and some representative companies. It’s a wide-ranging market, and there are many more players than listed here… and frequent changes in the line-up.

We need to keep one more set of vendors in mind: CRM players such as Salesforce.com, ZenDesk, Microsoft, Oracle, and SAP. Centers don’t typically use these for voice, even though some have started to offer these through acquisition (SAP, Oracle) or development (ZenDesk). They all partner and integrate with a variety of voice options. However, some centers use CRM to handle email, chat, or social media – albeit less robust in routing and reporting capabilities or integration with the other performance management tools compared to what the “typical” contact center technology solution has to offer. This is an area to watch as this market develops. Will there be mergers and acquisitions? Or will these companies add voice capabilities?

The current model could continue with vendors working together but it presents a difficult decision on what media gets handled where, with overlapping functionality for non-voice routing and reporting. Each option offers pros and cons (e.g., single multimedia routing and reporting engine versus more direct integration of contact tracking in CRM). Stay tuned on this issue!

It’s an exciting time for the rapidly maturing market of cloud contact center technology. If you’re a buyer, you can feel confident that you will find a solution that is a good fit, from a trustworthy vendor who will stand behind their solution. At the same time, given the level of competition and change, it’s important to bring a dose of skepticism and caution to the task.